Chalmers resists RBA rates risks

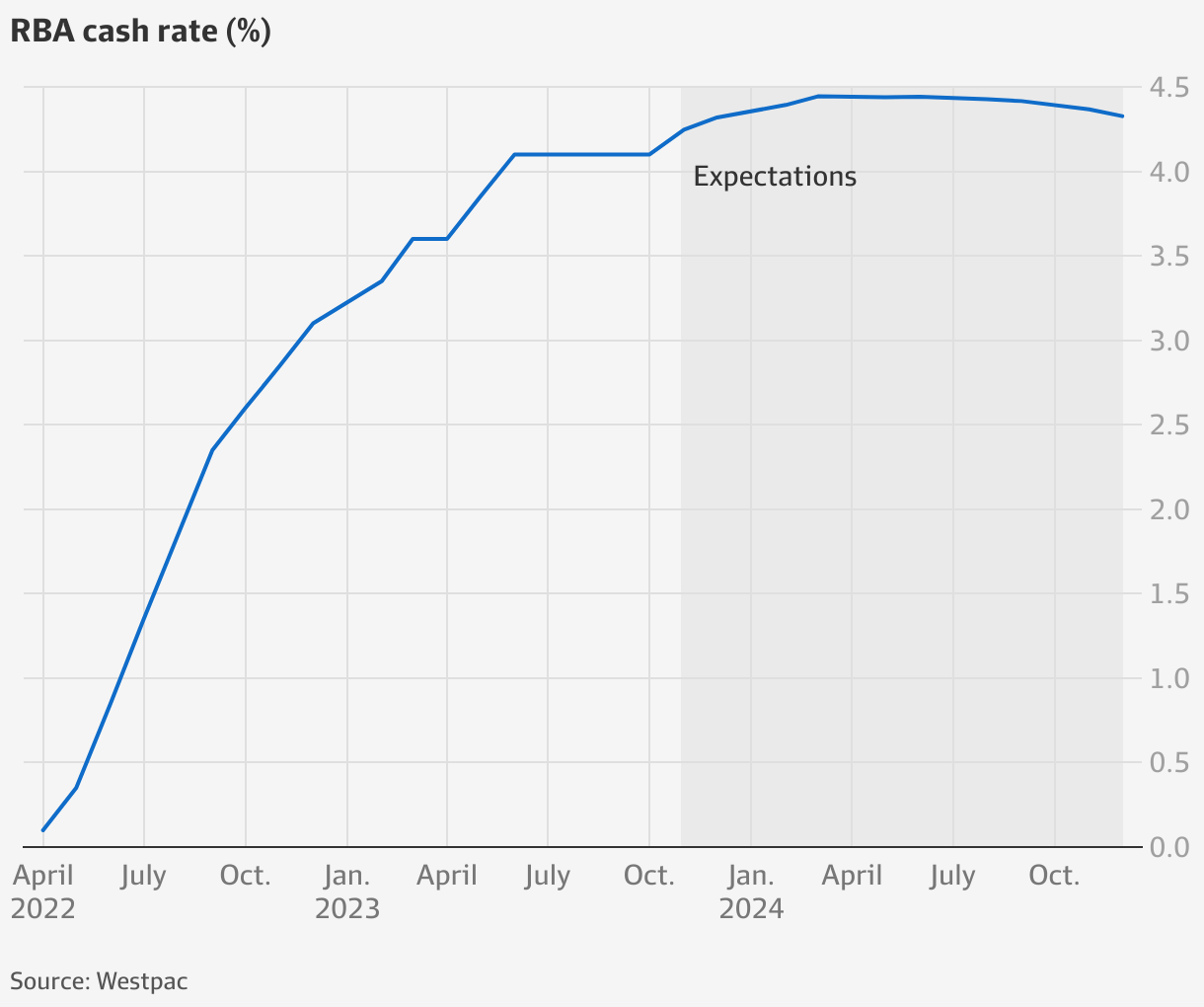

Treasurer Jim Chalmers has resisted predictions from economists and investors that stronger-than-expected inflation data will force the Reserve Bank to raise the cash rate up to two more times before Christmas.

Dr Chalmers said the acceleration of quarterly inflation to 1.2 per cent in the three months to September from 0.8 per cent in June due to surging petrol prices and rents did not amount to a “material change in the inflation outlook”.

RBA governor Michele Bullock said on Tuesday she would not hesitate to raise the cash rate above 4.1 per cent if there were a “material upward revision to the outlook for inflation”, reiterating her “low tolerance” for a prolonged period of high inflation.

Analysts were quick to jettison forecasts of a November rate pause after the release of the headline inflation figures, which were stronger than market expectations of a 1.1 per cent rise in the consumer price index and higher than the RBA’s official forecasts, prepared in August.

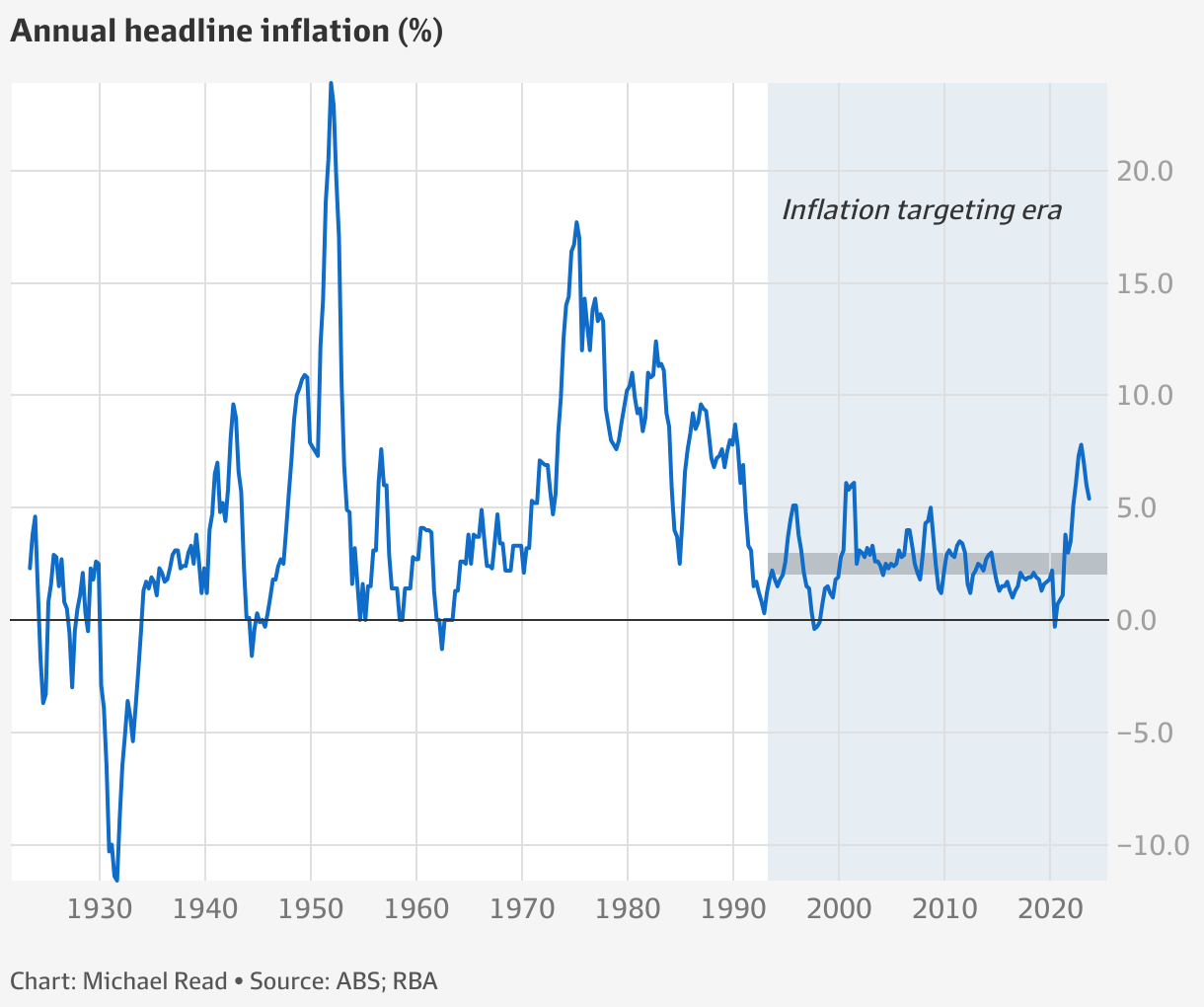

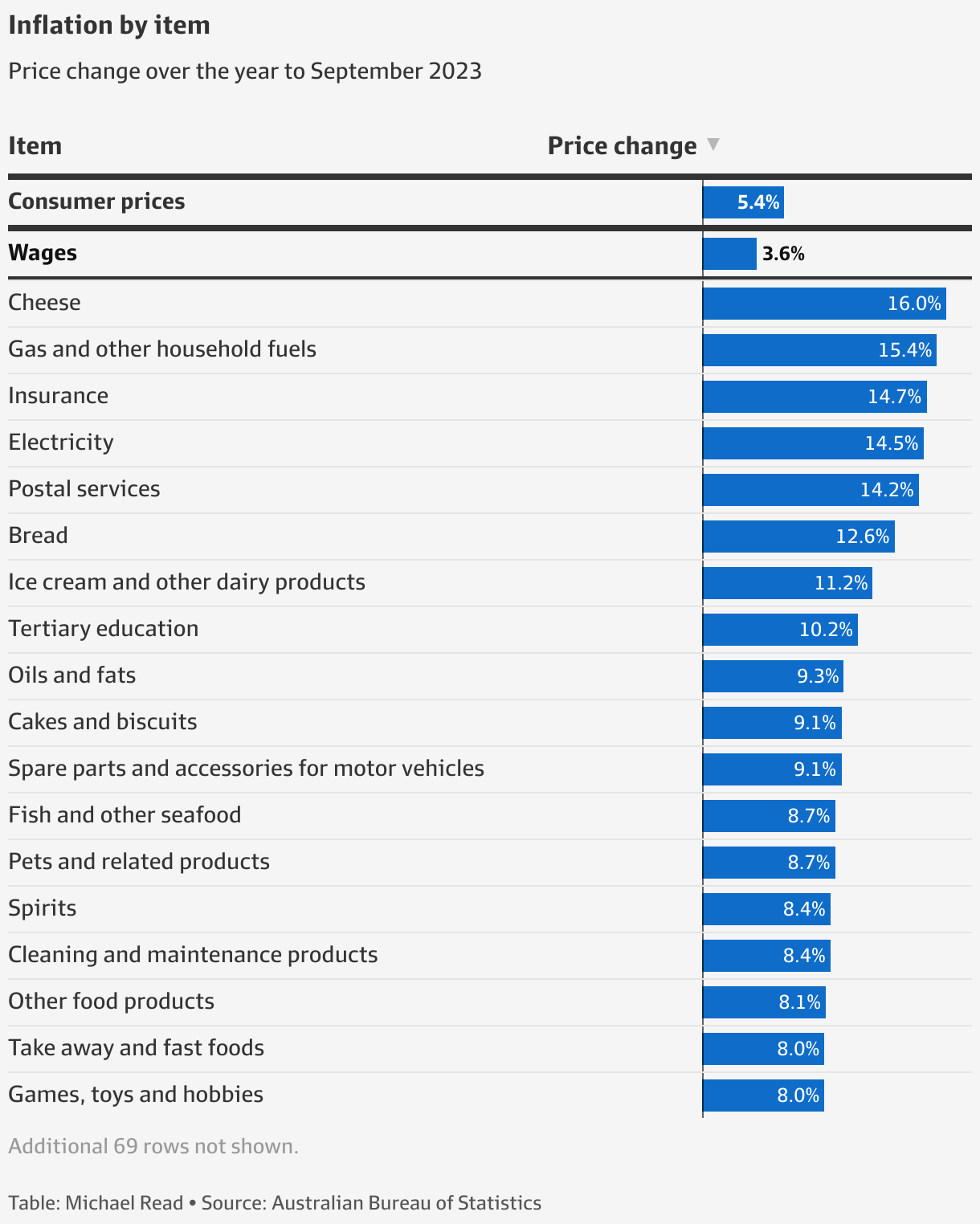

Wednesday’s higher-than-expected outcome meant annual headline inflation slowed by less than forecast to 5.4 per cent in the September quarter from 6 per cent in June, leaving inflation well above the RBA’s 2 per cent to 3 per cent target.

The benchmark S&P/ASX 200 has fallen 9.4 per cent since February, putting the local bourse within 1 per cent of a technical correction as equity valuations globally suffer from a multi-month surge in long-term bond yields.

The index was little changed at 6854.30 points on Wednesday, having dipped as low as 0.3 per cent following the release of the inflation data. The Australian dollar edged up 0.1 per cent to $US63.6¢.

In a concerning sign for the RBA, measures of underlying inflation were also stronger than expected. Trimmed mean inflation, which strips out volatile prices, was 1.2 per cent in the three months to September – well above the RBA’s forecast of 0.9 per cent.

While the majority of economists now view another rate increase as almost certain, Dr Chalmers downplayed the possibility the RBA board would be forced to raise the cash rate to 4.35 per cent from 4.1 per cent when it meets on November 7.

“The Reserve Bank looks for material changes in the inflation outlook,” Dr Chalmers said.

“[The RBA] will obviously assess these numbers in their own way, but what we’ve seen today is consistent with our expectations. It doesn’t materially change the inflation outlook going forward.”

However, economists largely disagreed with the Treasurer’s assessment, predicting the RBA would be forced to revise its inflation forecasts higher next month and raise the cash rate.

“We expect a high wages result in mid-November to underscore the risk of getting behind the inflation curve at a time of very weak productivity growth,” said Citi chief economist Josh Williamson.

He now expects the RBA to deliver back-to-back 0.25 percentage point cash rate rises on November 7 and December 5, having previously thought just one more rate rise likely. That would take the cash rate to 4.6 per cent from 4.1 per cent.

Investors were also far less sanguine than Dr Chalmers, with bond markets fully priced for another rate rise by the end of the year and ascribing a 65 per cent chance of a move higher next month.

Dr Chalmers said market expectations had not always been correct over the past year, as he stressed the cash rate decision would be made independently by the RBA board.

“[Market expectations] have been wrong on a couple of occasions from memory, so you need to be careful with those as well,” he said.

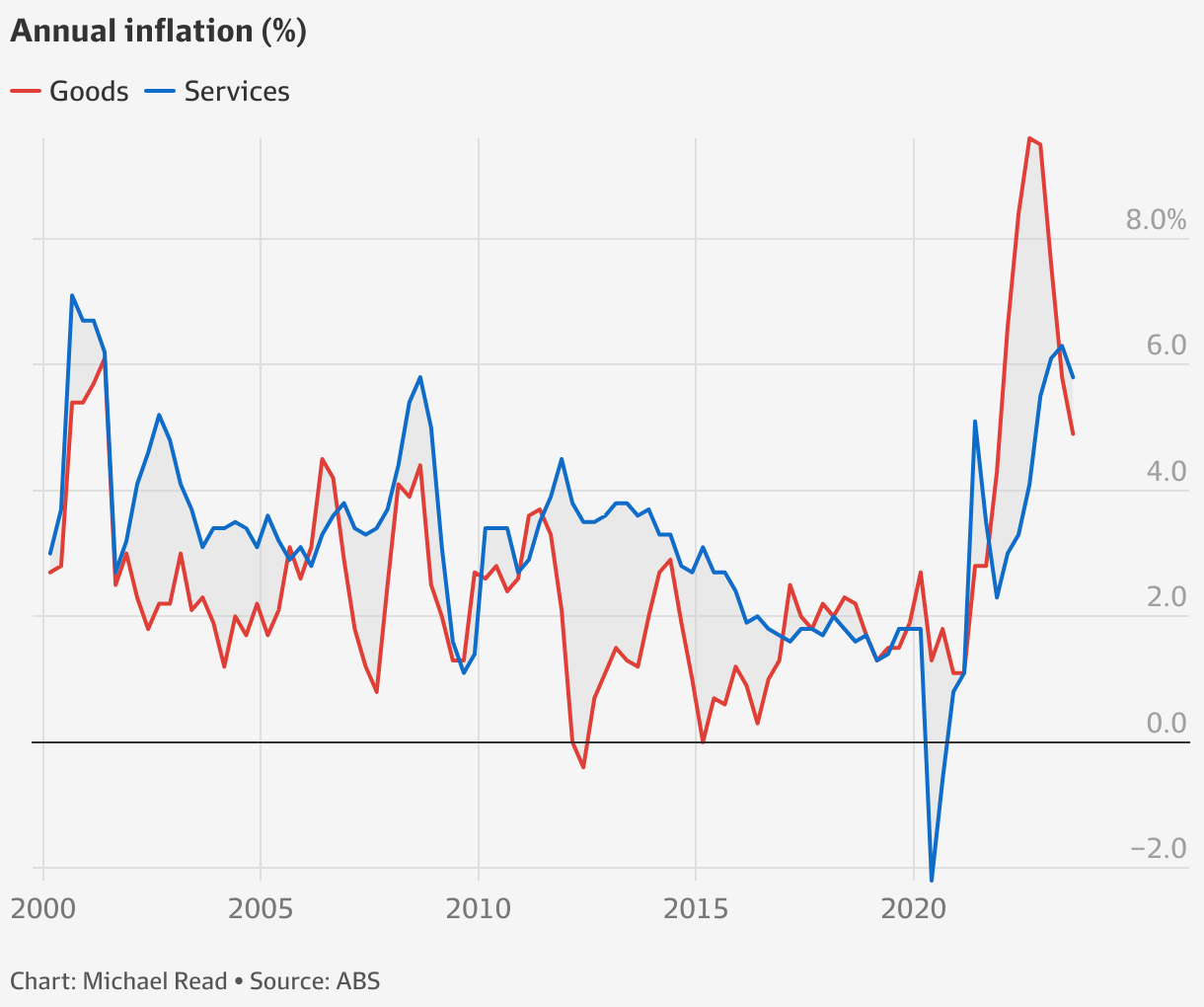

Economists said the data showed the RBA had made little in-roads into taming inflationary pressures in the labour intensive-services sector, which is proving a challenge globally.

Annual market services inflation, which is closely watched by the RBA as a gauge of labour cost-driven inflation, was 6.7 per cent. NAB senior economist Taylor Nugent said there were no signs of progress on disinflation in the services sector.

Deutsche Bank chief economist Phil O’Donaghoe said he expected back-to-back rate rises in November and December.

“Today’s CPI outcome lays the groundwork for what we expect will indeed be a material upward revision to the inflation outlook in the RBA’s upcoming November Statement on Monetary Policy,” he said.

Were the cash rate to hit 4.6 per cent, a household with a $750,000 loan would pay $1930 more a month on its mortgage than in May last year, according to RateCity.

No fuel excise relief

Underpinning the strength in inflation was a 7.2 per cent lift in petrol prices, which added about a quarter of a percentage point to inflation in the three months to September 30.

Asked whether he would contemplate temporarily reducing the 48.8¢ petrol excise to provide relief to motorists, Dr Chalmers said he had no plans to do so.

“We’ll contemplate what measures are necessary in our economy, consistent with our really strict approach to fiscal discipline, but it’s not something that we’re doing,” Dr Chalmers said.

Shadow treasurer Angus Taylor said further subsidies would not address the source of high inflation, which he said was falling labour productivity.

Brent crude oil is trading at $US88 a barrel after a months-long effort by major producers Saudi Arabia and Russia to take supply out of the market, which has offset concerns about a slowdown in demand from China and Europe.

The intervention has taken petrol prices above $2 a litre nationally, and there is little relief in sight for motorists as worries the US and Iran could become embroiled in the war between Israel and Hamas injects additional volatility into global oil markets.

Iran has boosted its crude oil exports this year, but markets are alive to the possibility the US could impose fresh sanctions if Tehran is officially linked to Hamas’ attack on Israel.

Treasury secretary Steven Kennedy said on Wednesday that developments in the Middle East made the economic outlook uncertain.

“That potential for higher inflation and ... lower global and domestic growth could quickly emerge should oil prices spike and remain at high levels,” Dr Kennedy told a Senate estimates hearing in Canberra.

ANZ head of Australian economics Adam Boyton said he now expected the RBA board to raise the cash rate in November, having previously thought the central bank would keep interest rates unchanged for the forseeable future.

“While 4.35 per cent should mark the peak in the cash rate, there is a risk it could tighten beyond that. Any easing remains a very long way off,” Mr Boyton said.

Services inflation pressure

HSBC chief economist Paul Bloxham said the inflation data were strong enough to justify another rate rise.

“The key question is whether the near-term upside surprise is enough for the RBA to change its view that inflation will return to its 2 to 3 per cent target band by late 2025,” Mr Bloxham said.

Central banks globally are grappling with a shift in inflation away from goods and towards services, where prices are increasing rapidly as firms pass on the cost of their burgeoning salary bills.

The trend means the cost of going to the vet grew by 7.5 per cent over the past 12 months, while the price of getting a haircut increased by 6.7 per cent and the cost of a restaurant meal went up by 6.1 per cent.

Electricity prices increased by 4.2 per cent in the three months to September and by 14.5 per cent over the past year. Energy bills would have jumped by 19 per cent over the past year were it not for state and federal government subsidies.

Adding to cost-of-living pressures over the past year was a continuing shortage of rental properties. Nationwide vacancy rates returned to a record low of 0.8 per cent in the September quarter, pushing rent inflation to a 14-year high of 7.6 per cent.

Rents were 9.5 per cent higher in Brisbane, 5.8 per cent higher in Melbourne, and 8.6 per cent higher in Sydney, and further increases are expected thanks in part to a strong increase in overseas migration.

Price pressures for non-essential items have eased thanks to a normalisation in supply chains and lower spending on discretionary goods, as households tighten their belts in response to the most rapid interest rate tightening cycle in decades.

Inflation in the cost of building a new dwelling – the largest item in the CPI basket – slowed to 5.2 per cent, down from a peak of 21 per cent last year, thanks to an easing in material cost pressures and softening demand.

Introducing your Newsfeed

Follow the topics, people and companies that matter to you.

Find out moreRead More

Latest In Economy

Fetching latest articles