Opinion

Inflation boosts chances of Cup Day interest rate rise

The jump in underlying inflation will be extremely hard for Michele Bullock to ignore as she tries to shore up the RBA’s credibility.

John KehoeEconomics editorIf you’re trying to make sense of what the inflation figures mean for interest rates, the news does not appear to be good for borrowers.

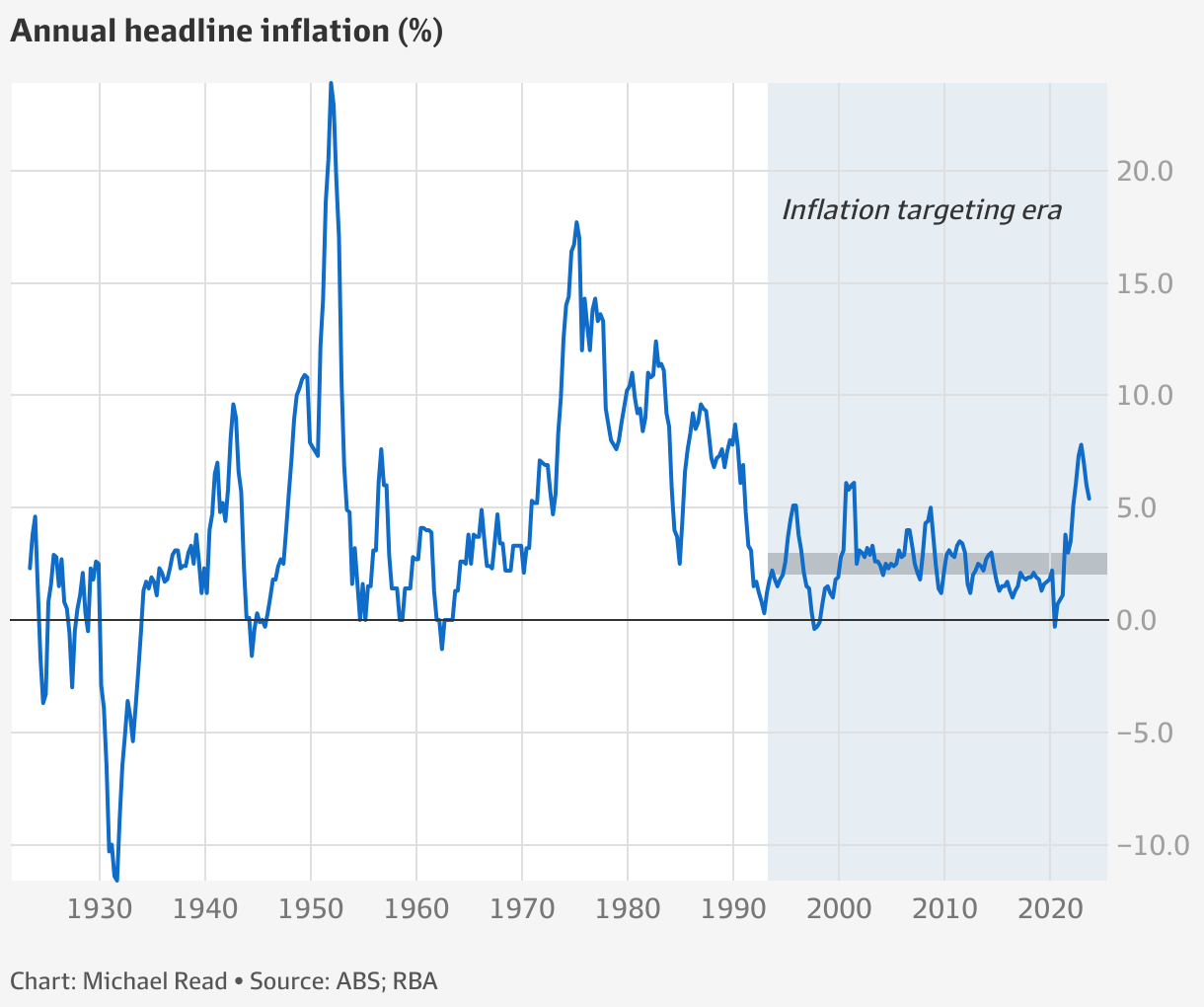

Ignore for now that annual headline inflation has continued to moderate to 5.4 per cent in the September quarter.

The Reserve Bank of Australia’s preferred measure of underlying inflation, which strips out volatile price movements such as for petrol and food, is accelerating.

The 1.2 per cent increase in trimmed mean inflation for the September quarter (5.2 per cent annually), was higher than the central bank’s implied forecast of 0.9 per cent for the three months.

Moreover, underlying inflation for the earlier June quarter was revised up slightly to 1 per cent, from 0.9 per cent.

For the sake of the RBA’s inflation-fighting credibility, the firm underlying inflation will be extremely difficult for new governor Michele Bullock and the central bank board to ignore.

The bank, perhaps reluctantly, will need to lean towards a 13th interest rate rise when it meets on November 7 on Melbourne Cup Day.

Sticky services prices

Worryingly, services inflation in labour-intensive sectors is proving stickier than hoped.

Services inflation rose 5.8 per cent in annual terms, down slightly from 6.3 per cent, but still uncomfortably elevated.

The cost of vets, restaurant meals, hairdressers, insurance, financial services and dentists is rising briskly.

Higher wages in services industries are being passed through to consumers after the government-endorsed increase in minimum and award wages without productivity increases.

This is evidence of domestic cost pressures adding to core inflation, not just global factors such as the oil price spike pushing up petrol prices that Treasurer Jim Chalmers is blaming.

Goods inflation eased to 4.9 per cent, as supply chain disruptions eased.

RBA governor Michele Bullock will consider an interest rate rise on November 7.

The RBA is already prepared to wait longer than other central banks until late 2025 for inflation to fall to the 2 per cent to 3 per cent target range.

The inflation data on Wednesday risks that timeline leaking into 2026 – threatening the bank’s credibility and risking pushing up inflation expectations.

Before the inflation figures, Bullock said on Tuesday night the 2025 target was “sort of at the end of our tolerance” and the board “would not hesitate” to raise rates if there was a “material” upside change to the inflation outlook.

“The board has been clear that it has a low tolerance for allowing inflation to return to target more slowly than currently expected.

“Accepting this would risk eroding public credibility in our commitment to low and stable inflation.

“And as I have discussed, the long-term costs to the economy if that were to happen would be considerable.”

Bullock would need to craft a credible story next month if the RBA decides against increasing the 4.1 per cent cash rate.

Indeed, holding rates steady could stretch the bank’s credibility that she is trying to shore up.

Unless, of course, she can explain how the upside surprise for the past inflation outcome does not meet her rate-rise criteria of a “material” upward revision to the outlook for future inflation.

The RBA staff’s updated forecasts will be released next month.

A cautionary factor the RBA is conscious of is real household incomes are being squeezed by inflation, income tax bracket creep and interest rates. Hence, per capita spending is going backwards.

On the other hand, rising house prices could make people feel wealthier and spend more than expected.

Money markets are pricing in a two-in-three chance of a rate rise in November, up from a one-in-three prospect before the inflation figures printed.

The market is fully pricing a 0.25 of a percentage point increase by December.

The bigger question is, will one rate hike be enough or will more be required?

Introducing your Newsfeed

Follow the topics, people and companies that matter to you.

Find out moreRead More

Latest In Economy

Fetching latest articles