Sydney, Brisbane, Perth house prices to rise 12pc this year

House prices in Sydney, Brisbane and Perth are predicted to climb by about 12 per cent this year, fuelled by the lingering supply shortfall and increased demand, according to an upgraded forecast by NAB.

The rosier prediction comes as expectations for a housing market recovery over the next few years by property professionals strengthen, with confidence levels hitting their highest levels in about two years.

Sydney house prices are poised to increase by around 12pc this year and by another 5pc next year.

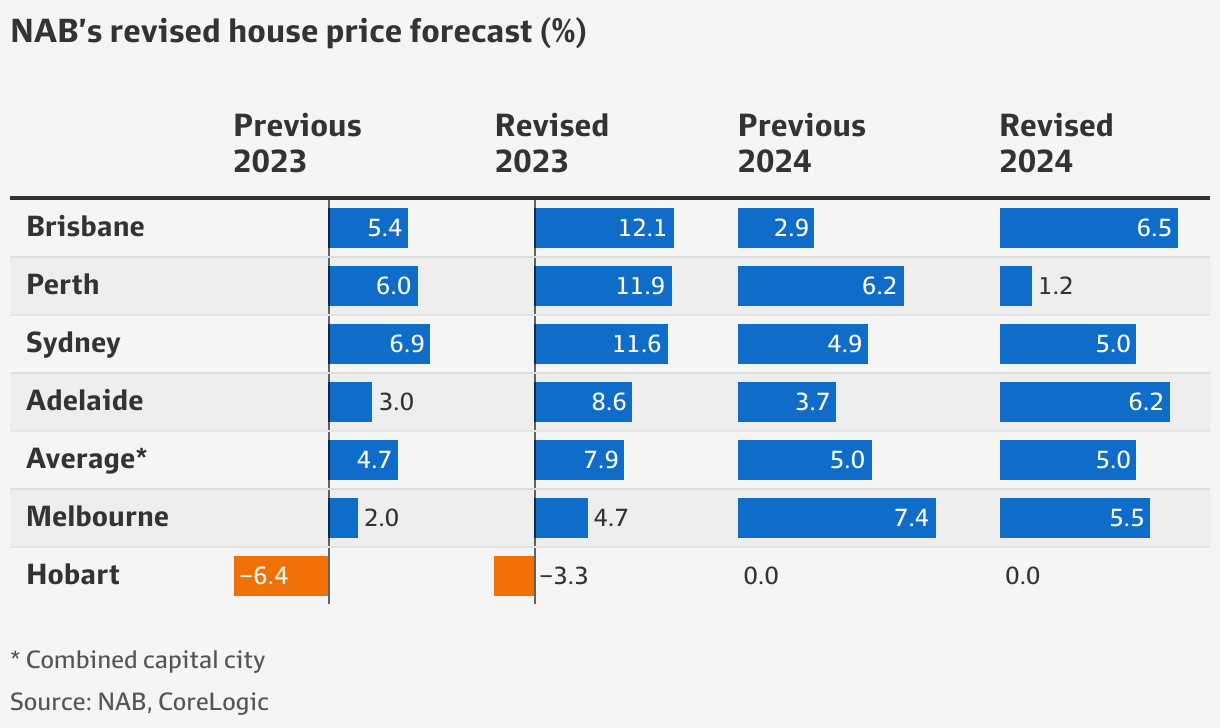

NAB has substantially upgraded its house price predictions from the previous quarter and now expects house prices across the combined capital cities to rise by 8 per cent this year and a further 5 per cent by 2024.

In July, the bank predicted national home values to increase by 4.7 per cent this year and 5 per cent in 2024.

NAB said a significant supply and demand imbalance amid rising rates and reduced borrowing power continued to support property prices, while strong population growth and a healthy labour market were expected to persist in the near term.

“We have revised up our outlook for dwelling prices in the near-term, expecting the CoreLogic eight-capital city dwelling price index to end the year up around 8 per cent following the slightly stronger than expected outcomes over recent months and the expectation that this will continue in the near-term,” NAB group chief economist Alan Oster wrote in his analysis.

Brisbane is poised to outperform this year and house prices in the city are expected to jump by 12.1 per cent. Perth is predicted to increase by 11.9 per cent and Sydney is set to rise by 11.6 per cent.

Adelaide is forecast to increase by 8.6 per cent and Melbourne to lift by 4.7 per cent, but Hobart is expected to drop by 3.3 per cent.

In July, NAB predicted Sydney house prices would rise by 7 per cent, Melbourne by 2 per cent and Brisbane by 5.4 per cent. The bank expected house prices in Adelaide to increase by 3 per cent, Perth by 6 per cent, and Hobart to fall by 6.4 per cent.

Dwelling prices continued to rise at a relatively solid pace across the major capitals in the third quarter. The combined capital cities increased by about 8 per cent since the start of the year, almost entirely reversing the fall seen over the preceding nine months.

The NAB survey found that confidence levels among property professionals continued to rise in the third quarter and there were heightened expectations for a housing market recovery in the next few years.

NAB’s one-year confidence measure lifted by 50 points in the third quarter, with the two-year measure stronger at 54 points. Both measures hit their highest levels in about two years and well above long-term average levels.

Expectations for house price growth in the next 12 months also improved across the country, except in the ACT where it fell by 1 per cent.

Property professionals reported very tight supply conditions in housing rental markets with a net 79 per cent assessing rental markets in their area as undersupplied.

Rising interest rates remain the biggest constraint for buyers of existing property nationally, followed by a lack of stock, particularly in WA.

Access to credit and price levels are a significant impediment for buyers in all states, except WA, while employment security and returns from other investments continue to have the least influence on home buyers.

NAB’s latest survey results also found a growing pool of foreign buyers. Their share of total market sales in new housing increased to a 5½-year high of 10.1 per cent.

Meanwhile, the overall market share of first-home buyers in new housing markets slumped to a near eight-year low of 30.3 per cent.

Introducing your Newsfeed

Follow the topics, people and companies that matter to you.

Find out moreRead More

Latest In Residential

Fetching latest articles